Most legacy banks don't give a stuff about their customers, says Philip Davies

Philip Davies, MP for Shipley, has written an exclusive op-ed for GB News members

|GB NEWS

By Philip Davies

Published: 28/12/2023

- 13:44Updated: 28/12/2023

- 18:54GB News presenter and MP for Shipley Philip Davies gives his view on debanking and bank branch closures in an exclusive op-ed for GB News members

Don't Miss

Most Read

Latest

I am not a fan of the banking sector – especially the legacy banks which have dominated the sector for many years.

On the last sitting day of the House of Commons before Christmas, I voiced my concern to the Treasury Minister.

I said: “It is pretty clear that most legacy banks do not give a stuff about their customers and just want to screw as much money out of people as possible."

Disappointingly the Minister didn’t appear to agree with that analysis, but I am not sure why. It seems to me that the evidence is pretty clear.

The banks are closing branches at record speeds, despite making billions of pounds of profits.

At this rate there will be no bank branches at all by the end of the decade, further damaging our town centres and high streets.

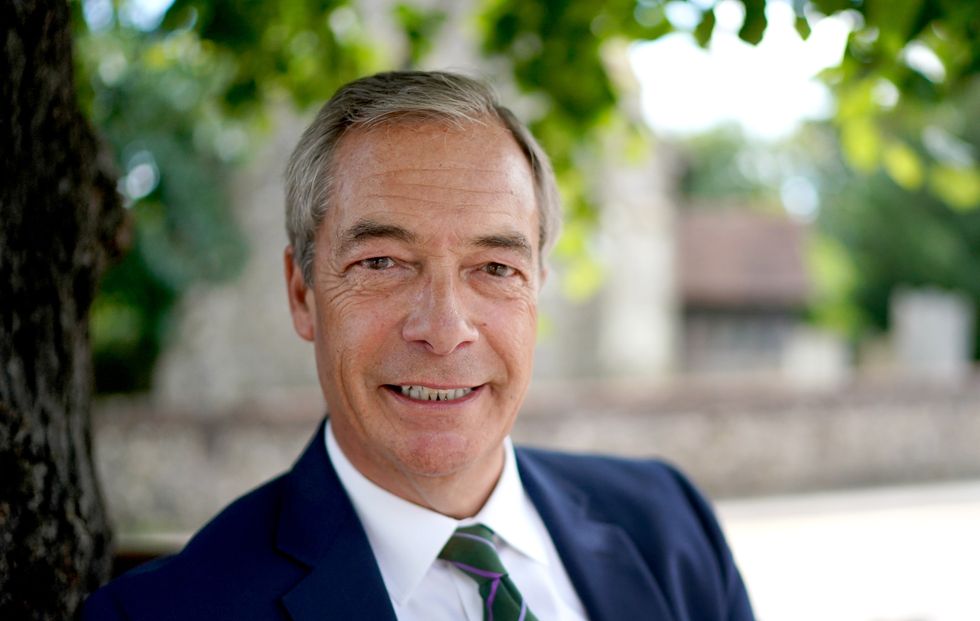

Nigel Farage uncovered a debanking scandal after being told his Coutts account would be closed

|PA

If a business is struggling financially then of course we all understand that cost savings must be made. But these major high street banks are not struggling financially, the branches are closing simply due to a combination of greed and contempt for customers.

Then there has been the debanking scandal – exposed by GB News’ very own Nigel Farage to such brilliant effect.

But what Nigel uncovered wasn’t just the appalling way Coutts Bank and its parent company treated him, he has exposed how widespread this practice is.

I am becoming increasingly aware of more and more people who are having their bank accounts closed for no good reason, and this is not just confined to individuals, but it is also happening to charities, community interest groups and businesses.

In fact, I am aware of a number of businesses which have closed down because a bank – where they have held an account often for decades – sends a letter to say that the account will be closed in 28 days without any reason given at all, and – in some sectors – it is virtually impossible to get another bank to open an account.

For businesses to be shut down in this way is completely unacceptable.

The reason these accounts are being closed isn’t because the business has done anything wrong, or broken any rules, it is simply because some bean counters at the bank have decided that they are not making any or sufficient money from these accounts. Again, it is down to pure greed and contempt for customers.

So what is the solution? There is a pathway to sorting out this appalling culture.

Ideally, these major legacy banks need a root and branch change in their culture to make customer service a much bigger priority.

But the chances of them doing anything so radical as caring about their customers is unlikely to happen voluntarily.

Therefore there are two external pressures which need to be applied.

The first of those is to give more encouragement and support to challenger banks. Monzo, Starling, Revolut, Tide, Cashplus and Allica – to name but a few – are all becoming much bigger players in the banking sector and the only reason they have been able to exploit a gap in the market is because of the lack of customer service in establishment banks.

I wish these new banks well in further eating into the market share of their bigger rivals.

However, the Government also has a useful role to play in changing the banking culture.

As a free-market capitalist who loathes state interference and high taxes, this sits very uncomfortably with me, but I fear there is no alternative.

LATEST DEVELOPMENTS:

If I were the Chancellor of the Exchequer I would get the big banking companies around a table and give them a simple message: “If I hear any reports of any more bank branches being closed, or people, businesses and other organisations having their bank accounts closed without wrongdoing involved, then I will levy a windfall tax on your profits.”

The establishment banks are drinking in the last chance saloon, and unless they voluntarily start putting their customers first, I am afraid that the government is going to have to force them into it.

Either they spend money on looking after their customers, or they spend that money on higher taxes to the Government – it would be their choice.

But they and their shareholders should no longer be allowed to get richer and richer by treating their customers and their local communities with contempt.